how much federal taxes deducted from paycheck nc

22 on the last 10526 231572. However the 2019 tax year for taxes filed in 2020 taxpayers will see a.

New Federal Tax Withholding Tables Nc Osc

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. As of 2015 FICA taxes for Social Security take 62 percent of your salary up to 118500. Plus to make things even breezier there are no local income taxes.

Our online Weekly tax calculator will automatically. Income Tax Deductions for North Carolina North. Your employer pays another 62 percent on your behalf.

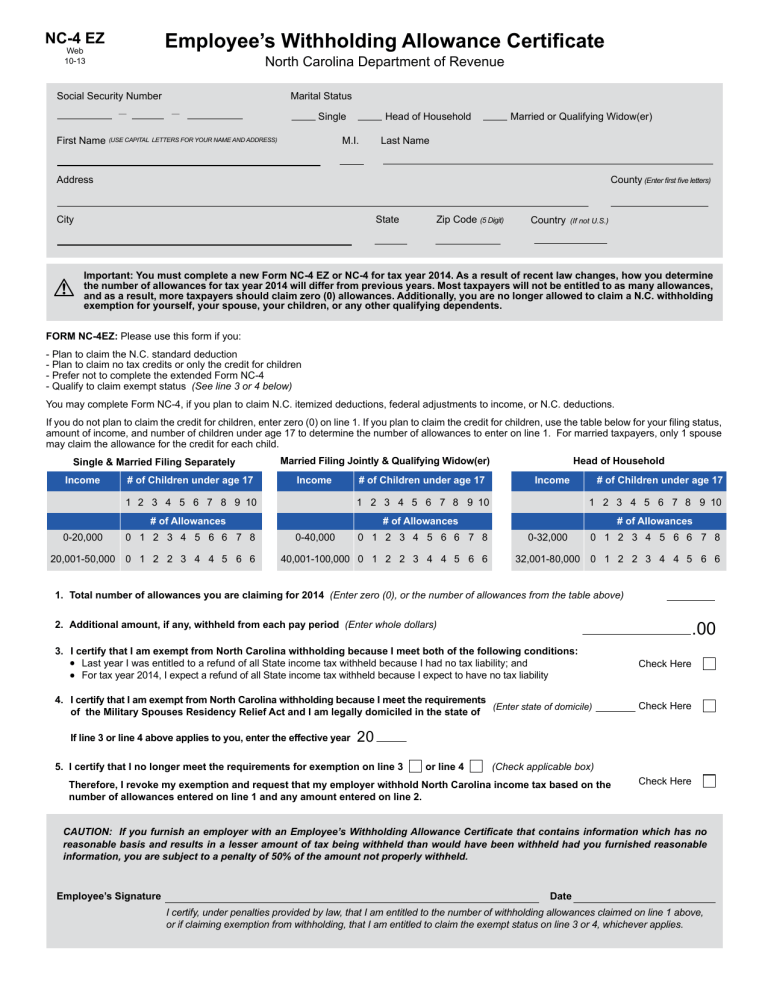

This is true even if you have nothing withheld for federal state and local income taxes. The only other thing you need to worry about is North Carolina State Unemployment Insurance. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. How much is taken out of my paycheck for taxes in NC. Deductions for the employers benefit are limited as follows.

There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted. Please remember that the income tax code is very complicated and while we can provide a good estimate of your Federal and North Carolina income taxes your actual tax liability may be different. 10 on the first 9700 970.

Federal income tax rates range from 10 up to a top marginal rate of 37. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

A in non-overtime workweeks wages may be reduced to the minimum wage level but cannot go below the minimum wage currently 725 an hour and b during overtime workweeks wages may be reduced to the minimum wage level for the first 40 hours. Plus to make things even breezier there are no local income taxes. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

North Carolina has an individual income tax rate of 525 that applies to all income levels. Federal Paycheck Quick Facts. Employee Pay Stub.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. These taxes are likely labeled FICA which stands for Federal Insurance Contributions Act on your paystub. 12 on the next 29774 357288.

However NO deductions can be made from the full. And like North Carolina employers are solely responsible for paying FUTA tax. If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when you retire.

North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019. The North Carolina income tax has one tax bracket with a maximum marginal income tax of 525 as of 2022.

There is a flat income tax rate of 525 which means no matter who you are or how much you make this is the rate that will be deducted. Median household income in 2020 was 67340. With the 2019 tax code 62 of your income goes toward social security and 29 goes toward medicare tax but if youre employed by a company full-time they pay half of your medicare responsibilities so you should only see 145 taken from your pay.

The state of North Carolina has an income tax rate of 549 percent for the 2018 tax year. Our online Monthly tax calculator will. States dont impose their own income tax for tax year 2022.

Federal Income Tax Withholding. North Carolina Tax Deductions. Youd pay a total of 685860 in.

You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. If you earn more than 200000 in a year your employer must withhold an additional 09 percent for the additional Medicare tax. For 2022 its limited to 6 of the first 7000 of an employees wages each year.

This can make filing state taxes in the state relatively simple as even if your salary changes youll be paying the same rate. Many employers will qualify for tax credits to reduce the rate to 06 by paying their state unemployment taxes on time. If youre single and you make 50000 after subtracting deductions exemptions etc you would pay.

For Medicare you both pay 14 percent no matter how much you make. Our calculator has been specially developed in order to provide the users of the calculator with not.

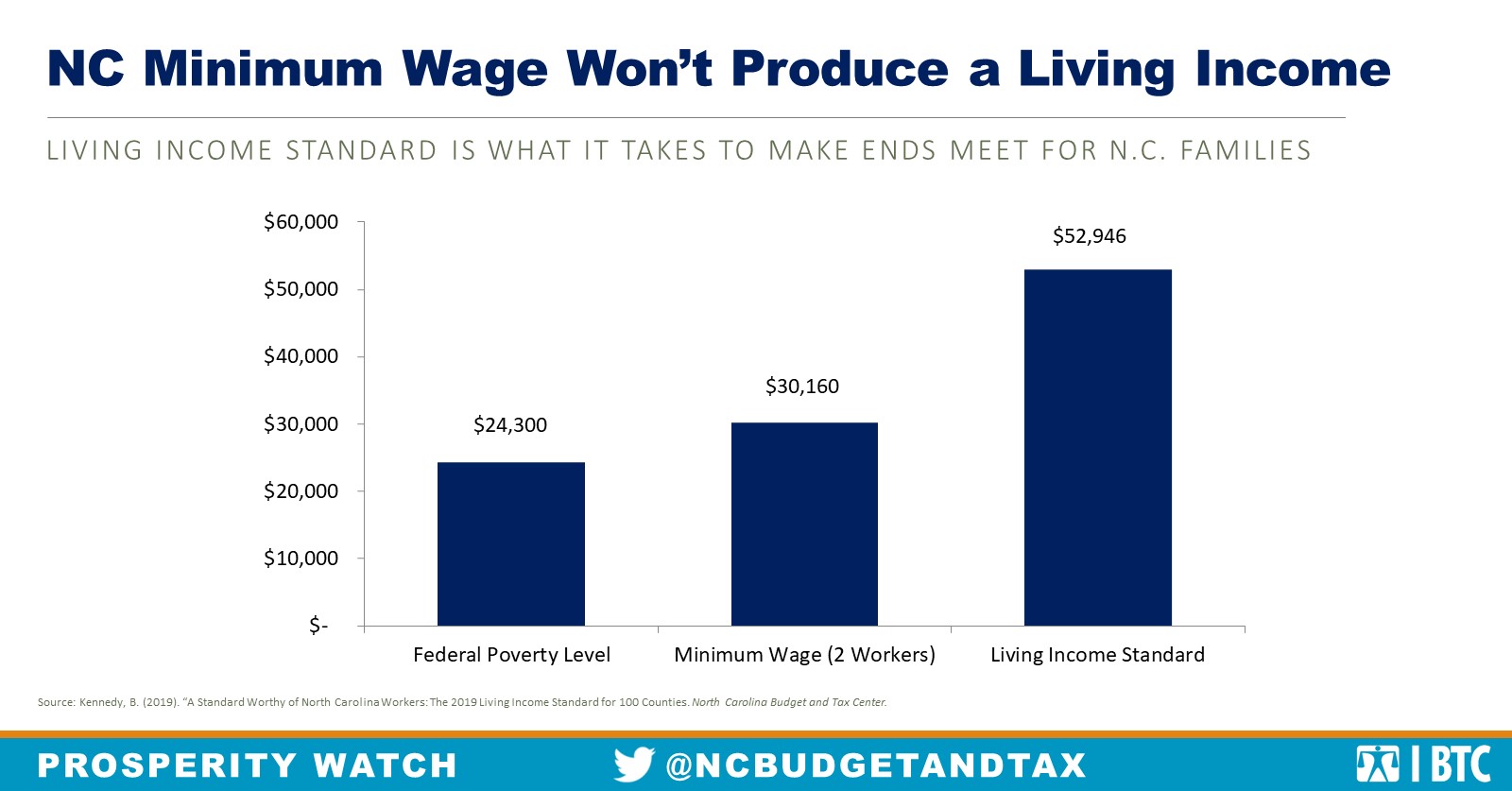

Minimum Wage Doesn T Cover The Basics In Any North Carolina County North Carolina Justice Center

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Des North Carolina Makes First Lost Wages Assistance Payments

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself

North Carolina Providing Broad Based Tax Relief Grant Thornton

North Carolina Tax Relief Information Larson Tax Relief

Irs Form 1096 Irs Forms Irs Internal Revenue Service

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

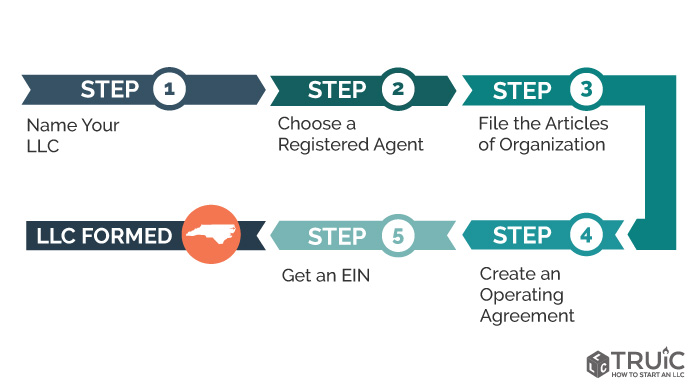

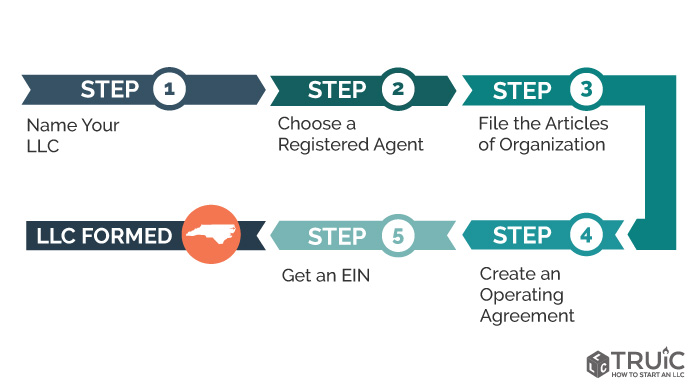

Llc In Nc How To Start An Llc In North Carolina Truic

North Carolina Low Income Tax Clinic Charlotte Center For Legal Advocacy

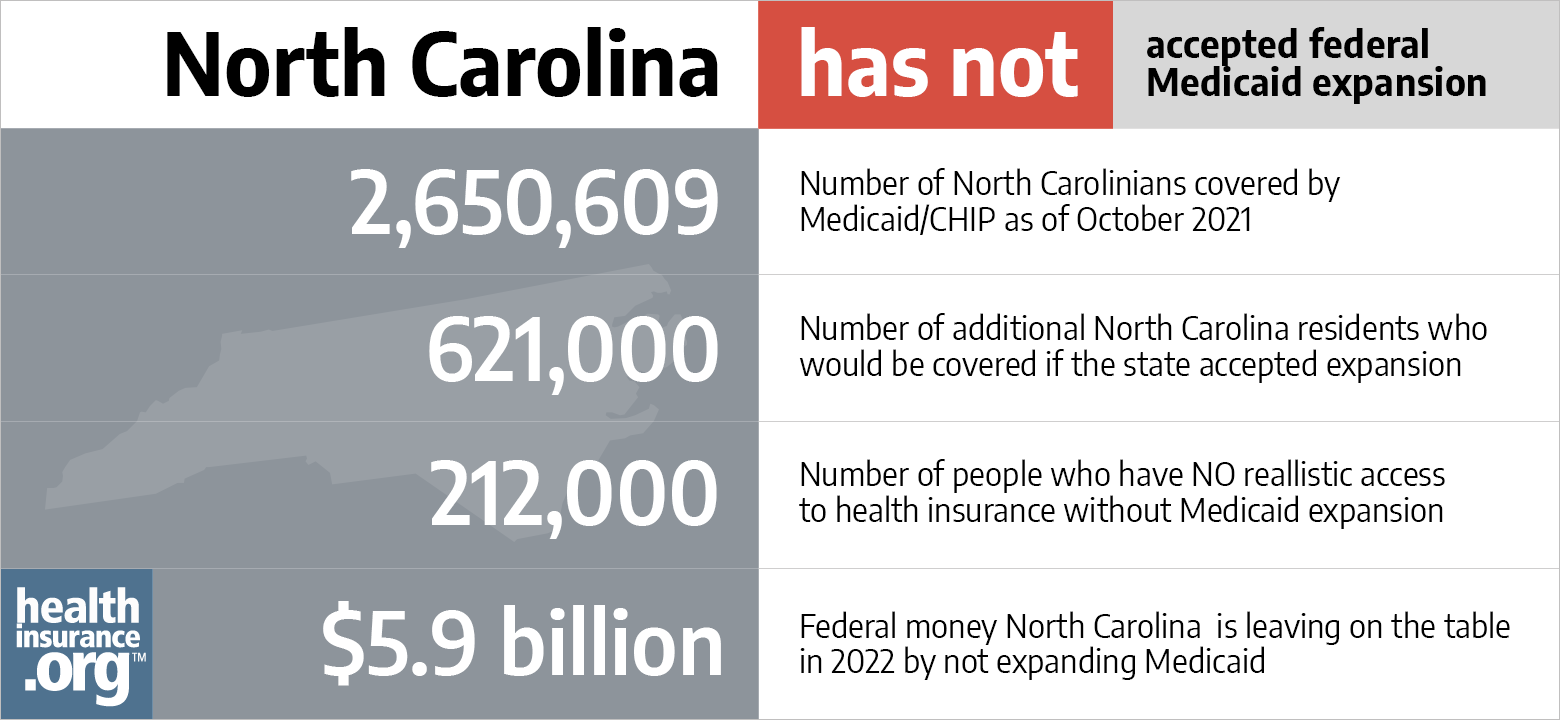

Aca Medicaid Expansion In North Carolina Updated 2022 Guide Healthinsurance Org

North Carolina Sends Thousands In Fraudulent Unemployment Claims During Covid 19 Pandemic Abc11 Raleigh Durham

North Carolina Income Tax Calculator Smartasset